Rewarding

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

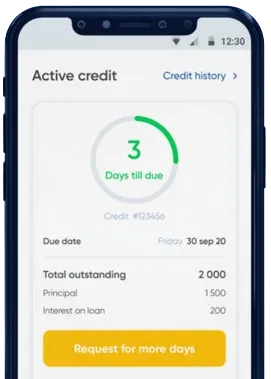

Get fast and simple solutions without stepping out. Instant fund transfers with options to extend loans

Apply through the app by completing the necessary form.

Stay tuned for a decision, usually ready in 15 minutes.

Have the money transferred to you, usually within one minute.

Apply through the app by completing the necessary form.

Download loan app

Fast payday loans in South Africa are a popular financial tool for many individuals who find themselves in need of quick cash. These short-term loans can be a lifesaver in emergencies when traditional banks may not be able to provide immediate assistance.

One of the main benefits of fast payday loans is the speed at which they can be obtained. Unlike traditional bank loans that may take weeks to process, payday loans are typically approved within hours or even minutes, making them a convenient option for those in urgent need of funds.

Another benefit of payday loans is the minimal requirements for approval. Most payday loan providers in South Africa require applicants to have a steady income and a valid bank account, making them accessible to a wide range of individuals, including those with less-than-perfect credit scores.

Additionally, the repayment terms for payday loans are typically short, usually ranging from a few days to a month. This allows borrowers to quickly repay the loan and avoid long-term debt, making payday loans a viable option for short-term financial needs.

Fast payday loans can be useful in a variety of situations, including unexpected medical expenses, car repairs, or other emergencies that require immediate financial assistance. By providing quick access to cash, payday loans can help individuals cover these expenses and avoid financial crisis.

Moreover, payday loans can also be used to bridge the gap between paychecks for individuals who are temporarily short on funds. This can help prevent late payments on bills or other financial obligations, ultimately saving borrowers from penalties or additional fees.

Overall, fast payday loans in South Africa serve as a valuable resource for individuals who need quick access to cash in times of financial need. By offering quick approval, minimal requirements, and short repayment terms, payday loans provide a convenient and accessible solution for short-term financial emergencies.

In conclusion, fast payday loans in South Africa offer numerous benefits and can be a useful tool for individuals facing financial emergencies. With their quick approval process, minimal requirements, and short repayment terms, payday loans provide an accessible and convenient solution for short-term financial needs. However, it is important to borrow responsibly and ensure that you can repay the loan on time to avoid falling into a cycle of debt.

Fast payday loans are short-term loans that are typically repaid on the borrower's next payday. They are designed to provide quick access to cash for those who need it urgently.

In South Africa, individuals can apply for fast payday loans online or in person at a financial institution. The borrower will need to provide proof of income and identification to qualify for the loan.

Typical requirements for obtaining a fast payday loan in South Africa include being employed, having a valid South African ID, and having a bank account for the loan funds to be deposited into.

The amount that can be borrowed with a fast payday loan in South Africa varies depending on the lender and the borrower's income. Generally, loans range from R500 to R8000.

Interest rates for fast payday loans in South Africa are typically higher than traditional loans, ranging from 20% to 30%. It is important to carefully review the terms and conditions of the loan before agreeing to the interest rate.

Some lenders in South Africa may offer loan extensions or rollovers, but this often comes with additional fees and interest charges. It is important to carefully consider the consequences of extending a payday loan before making a decision.